Active Mutual Funds vs. Index Funds: Costs & Performance Guide

Active Mutual Funds vs. Index Funds: Costs & Performance Guide

There has been a status quo in the Mutual Funds industry for years. The funds kept flowing in due to excessive marketing. The Profits for fund houses kept surging. Whenever, a business is profitable, more competition emerges to share the profit. There are 100s of Equity oriented funds today in the market. A long list of Mutual funds makes the investor spoilt by choice. This article clears some common myths around the costs involved in investing via Active Mutual Funds vs. Index Funds. We compare the cost with Index funds and see if it is worth investing in an actively managed Mutual Fund. We then see if there is an easy way to pick a fund based on returns and expense ratio.

Before diving further, lets understand some common terms in use for Mutual Funds.

Benchmark Index: The Foundation of Active Mutual Funds vs. Index Funds

Benchmark Index is a bucket of stocks, created by BSE/NSE and acts as a window to Markets. It tells you broad picture of the market by taking a bucket of 50-100-200 stocks as a sample. This is the foundation for understanding Active Mutual Funds vs. Index Funds. This bucket itself keeps undergoing change with time. Statistically, the index gives you a clear picture of what the real time market sentiment looks like. For example, global audience views India Markets via NIFTY/Sensex indices. The BSE/NSE decides the list of stocks and their weightage in the index composition

If a fund manager were to invest in such a basket, his/her job was relatively easier. In this case, the system decides for them what to buy and how much to buy. This also takes away the risk of 'Fund Manager skill' and automates the process. These benchmarks guide Mutual Fund Managers and help investors judge, how their funds are doing against fixed buckets.

Understanding the Cost Differences in Active Mutual Funds vs. Index Funds

Total Expense Ratio (TER) and Its Calculation

The Total Expense Ratio (TER) is the Annual Fee that an investor pays to the Mutual Fund. It covers operating expenses for the Mutual Fund. These expenses include-

- management fees,

- administrative costs,

- marketing expenses, and

- other operational costs needed to run the fund

An investor will not notice these charges because it is built into the NAV. The daily NAV is the fund value minus the expenses.

Formula for Total Expense Ratio:

Total Expense Ratio= Total Fund Expenses / Total Assets Under Management (AUM)

This means the higher the expense ratio, the lower the investor’s net returns.

Why Do Expense Ratios Vary Across Funds, and Should You Always Choose the Cheapest One?

Some funds invest in special assets where the operating charges are higher. For example, A fund investing in US Markets will have a higher expense ratio, due to higher brokerage and transaction charges. It can be expensive due to Fund Manager skill. This is where the question of paying extra for activity comes in.

What else does the Total Expense ratio include?

Additionally, TER may include a Mutual Fund 'Distribution Fee', which is the money transferred to the Distributor. A few years ago, Asset Management Companies started providing 'Direct Funds' instead of regular one to take the 'Distribution Fee' out. Almost all Mutual Funds come with a direct and regular plan. The Total Expense ratio includes the Distribution Fee in case of regular fund. This is waived off for direct fund because you don't buy it through a distributor.

What does an Investor get from a Mutual Fund distributor having paid a higher Expense ratio?

Ideally, The distributors should inform the clients about this fee. Some are doing it diligently, others may be not. One also needs to keep in mind, this fee is directly related to AUM. As your fund size grows, the distribution fee also grows.

A distributor must advise you on your portfolio by providing you information on funds you own. Re-balancing by switching of funds in portfolio can help improve the returns. If a distributor does not add this value, you may want to switch to direct funds. A DIY model is very popular these days because of availability of Direct funds and cheaper Platforms. This has it own disadvantages if not done correctly due to un-advised and uninformed decisions. Especially in a market scenario like current one, this can become trickly and a need for Advisor arises.

Index Funds come with Cheaper Expense Ratio due to Simplicity

A fund Manager of Index funds will simply invest in stocks as per the benchmark recommendation. For example, a NIFTY Index fund would contain all the NIFTY 50 stocks with weightage as per the index. Index Funds come with cheaper expense ratio due to their simplicity.

In their Accumulation Phase, Investors should focus on their primary income more than returns on investment. So, a minor increase in Expense ratio wouldn't matter much. Index fund is advisable sometimes for peaceful investing as well as cheaper cost. It is peaceful because there are fewer parameters to make it volatile. It just goes based on overall market sentiment.

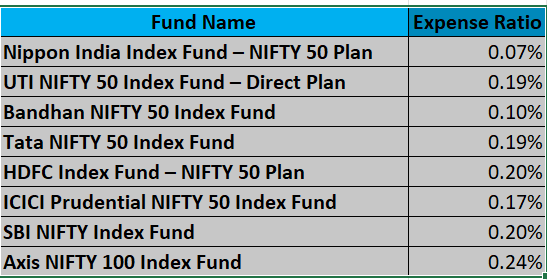

Check out some Index funds and their expense ratio. As you see, Index funds are cheaper in management. Hence, they come with lower expense ratio compared to actively managed Mutual Funds. An active Mutual Fund charges higher expense ratio in the pretext of generating better returns. We will see later that the data suggests only ~20% of the funds in the Mutual Fund universe beat the Index.

Continued under-performance compared to benchmark indices.

Let's look at some research data. This SPIVA (S&P Indices Versus Active Funds) India scorecard from 2023, presents a gloomy picture for Active Fund Management:

Large-Cap Funds:

a) 1 year period: The S&P BSE 100 gained 23.2% in 2023, and 51.6% of active managers under-performed the benchmark over that period.

b) 3 to 5 years: Under-performance rates were significantly high over the three- and five-year periods, at 87.5% and 85.7%, respectively.

c) 10 years: Active managers produced relatively better results over the 10-year period, with the under-performance rate dropping to 62.1%.

Mid- & Small-Cap Funds:

a) 1 year period: The benchmark for Indian Equity Mid-/Small-Cap funds, the S&P BSE 400 Mid-SmallCap Index, rose 44.0% in 2023, and 73.6% of active managers under-performed the index over that period.

b) 10 year period: The story for longer period is slightly different from large cap segment. Equity Mid-Small-Cap funds fared the worst in the long run, with 75.4% of them lagging the S&P BSE400 MidSmallCap Index over the 10-year period ending December 2023.

Going by the data presented, most active funds are under-performing the benchmark index. So, why do Investors pay Fund Managers extra in the form of expense ratio, in spite of under-performing? Aren't the investors better off doing Index fund instead? This also makes it simpler for them as there is less to track and less expense too. It is best to take the money out of these funds.

You would now question whether a high expense ratio of a Mutual Fund is justified. If the Fund Manager does not generate higher returns by managing it actively, why pay high?

Do All Mutual Funds Underperform Their Benchmark?

Check the output list below (Based on data till December 2024). We found 22 Mutual Funds, that stand out in terms of returns against their benchmark. We mined through around 150 mutual funds and arrived at these funds which beat benchmark handsomely across different time frames. These funds have a return greater than the benchmark in 1 year, 5 year and 10 years time frame. Alpha here is simply the difference of fund return from the benchmark return.

Notice, the alpha going down for regular funds because of the extra spend as expense ratio, compared to direct funds. Only 22 of the funds managed to positively beat the benchmark index on a longer time frame. This is not to suggest that returns should be the only benchmark to judge the performance. There are other factors too. But, going purely by returns, there are very few who manage to beat the benchmark in a long term basis. This is not to say we should not choose the other funds. With right allocation and rebalancing, many funds can generate better returns.

Should You Choose Index Funds Over Active Mutual Funds?

Advantages of Index Funds

- Lower expense ratio (typically 0.1%-0.5% vs. 1.5%-2.5% for active funds).

- No fund manager risk – purely tracks the market index.

- Less stress – fewer variables to monitor.

When Active Funds May Be Worth Considering

- If a fund has a consistent history of outperforming the benchmark.

- If the extra cost is justified by better risk-adjusted returns.

- The Fund Manager quality based on their track record.

How to Pick the Right Mutual Fund?

- Eliminate 70% of underperforming funds based on long-term SPIVA data.

- Choose Index Funds for simplicity and cost-effectiveness.

- If opting for active funds, pick only those with a strong track record over 10+ years.

- There are good resources online which measure the risk adjusted returns ratios to assess quality of funds.

- You may also want to check Portfolio turnover ratio and the asset allocation to understand better.

Final Thoughts: Making the Right Choice with Active Mutual Funds vs. Index Funds

After looking at various expenses in Mutual Funds, some may move to direct stocks to save the cost. Is it that simple? Do we switch to self-medication to avoid paying fee to a Doctor? Are we expecting everyone to become an expert Fund Manager? Do you think, with your skills, you will beat the Index while ~80% of the expert world can't? If that is not the case, why get into that trap for saving that extra 1% Expense ratio? If cost is a concern, go for cheaper index fund. Alternatively, switch to a better managed Fund which has consistently generated better returns.

Effective financial planning helps investors make informed decisions about choosing between active mutual funds vs. index funds, ensuring long-term wealth growth. By becoming more informed, you can save on the distribution fee by buying direct funds instead of regular. This is another way to improve your returns. That would mean, you should do your diligence and understand which fund to pick.