Real Estate vs. Equity: A Logical Comparison for Wealth Generation

Real Estate vs. Equity: A Logical Comparison for Wealth Generation

When it comes to wealth creation, real estate is an asset class that the entire world is familiar with. If opinions alone determined value, real estate would triumph over equity every time. So, let's delve into Real Estate vs. Equity.

Real Estate vs. Stock Market: Which to Choose?

The sheer exposure of real estate in the human mind space makes it the go-to investment. However, my job is to present logic over unfounded opinions.

How Asset Prices Appreciate:

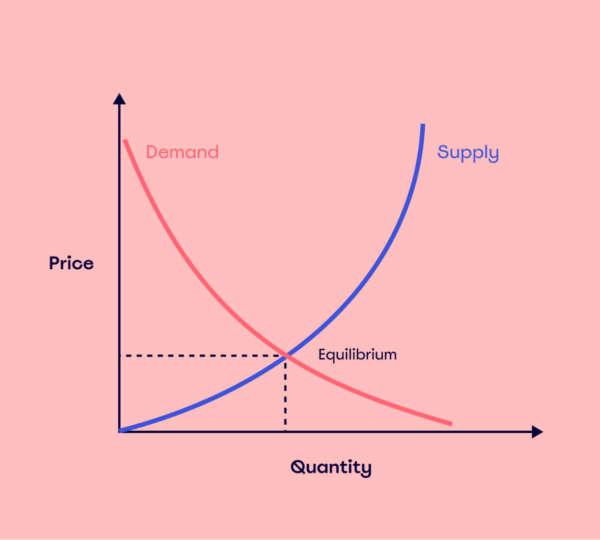

To understand the difference between real estate and equity, let's first understand how asset prices appreciate. The basic demand-supply curve tells us that higher demand for an asset with limited supply leads to price appreciation.

Before we delve into details, let's understand how we represent returns on an asset mathematically.

Returns = interest rate + inflation premium+ liquidity premium+ risk premium+ maturity premium

For example, FD and debt instruments have inflation premium along with RBI determined interest rate. As we will see further, real estate comes with liquidity premium, but limited risk premium.

Understanding Real Estate Investment: A Local Market

Real estate is a a local market. The demand is limited to local buyers or a few investors with stakes in the area. The price depends on local factors, including the extent of urbanization, development, and buyer affordability.

Mathematically, real estate returns can be described as:

Returns = interest rate + inflation premium + liquidity premium

Real estate typically has an inflation-adjusted return and a liquidity premium. The liquidity premium is derived from ease of sale. How easily you are able to buy or sell an asset will define liquidity. The biggest risk in Real estate is the risk of not being able to sell at a desired price, when you want to. This leads to price appreciation due to the liquidity risk. The real estate however, lacks a significant risk premium since it is generally less volatile. Risk premium comes with business risk which is more applicable in Stock Market.

Key Benefits of Stock Market Investment

Equity represents an investment in a business, inherently tied to the risks and uncertainties of that business. Unlike real estate, equity comes with a risk premium due to the volatility and unpredictability of business earnings. Additionally, the liquidity premium in equity is sometimes visible in markets where demand outpaces supply. Liquidity of assets determine the returns. Highly illiquid stocks tend to give better returns similar to high returns sometimes in real estate when the demand is on rise whereas inventory is limited.

Mathematically, equity returns can be described as:

Equity returns = interest rate + inflation premium + liquidity premium + risk premium

As you see, the returns in Equity has an element of liquidity and risk premium. This tends to give better returns most of the times, specially when the business risk is high. The risk premium is what gives equity an edge over other asset classes.

Risk Factors : Real Estate vs. Equity

Understanding the liquidity premium is crucial. In real estate, liquidity premium can turn negative if there's no buyer for the asset you hold. There are many such stories!! In equity, small-cap stocks often give better returns due to their lower market cap and hence faster reaction to demand changes. Liquidity premium needs to be used to your advantage. It can become a risk if you have to do a distress sell.

Challenges for Equity Markets

Despite the logical advantages of equity, real estate often wins in opinion polls due to several challenges in equity markets:

Infrastructure: The ease of buying and selling in equity is a big disadvantage for wealth creation, leading to short-term holdings. There are limited stories of people holding Asian Paints or HDFC bank for decades, but lots of stories where your grand father bought a land and you are reaping it's benefits!! Very few tell u that grand father didn't sell because he couldn't.

Leverage: Real estate benefits from loans, allowing for larger investments with less cash, unlike equity, which is mostly cash-based. With 10 lac of limited capital, you can dream of buying a 1 crore house with a leverage of 20-30 years at low interest rates!! Equity has no such option unless we want to bring intra day and derivatives in the argument.

Financial Literacy: Many people are unfamiliar with capital markets, reducing demand for equity investments. We have tough time explaining people on treating equity as an asset. It's seen as a ticket to amusement park where you can buy low and sell high!! Because of this simplistic explanation, people don't pay attention to details and avoid learning it too. Real estate is relatively easier to learn and the strong belief that it never goes down makes it more popular.

Conclusion: Real Estate vs. Equity

Equity has the potential for significant wealth generation if treated as a serious investment rather than a short-term gamble. Real estate may lag behind equity in returns, but it remains a popular choice due to familiarity and accessibility. However, when it comes to Real Estate vs. Equity and long-term wealth creation, equity holds the edge. This blog is not to argue against buying your dream house. Home obviously is not an investment in real terms, but only an emotional one. Having a house of your own is always a blessing and consider buying one if it's within your reach.

Happy investing!!