The Great FIRE Debate: Financial Independence, Retire Early

The Great FIRE Debate: Financial Independence, Retire Early

COVID introduced us to many new terms that were relatively unknown before. Financial Independence Retire Early, popularly known as FIRE is one such term which this article focuses on. Before we get there, lets see the lose chronology of events in Corporate World, post COVID.

We learned about moonlighting, where companies complained about employees holding multiple jobs simultaneously. A notable incident was when Wipro fired 300 employees for moonlighting, bringing the issue to the forefront, with many other companies following suit.

Then came the concept of quiet quitting, where employees disengaged from their roles without formally resigning, choosing to hang around until they were eventually let go. While quiet firing—where employers subtly force employees out—has long existed, quiet quitting was a newer trend.

We also encountered the term The Great Resignation. Many employees, prioritizing life over work, began resigning in pursuit of better career opportunities or better work-life balance. This shift caused quite a stir in HR circles, as the cost of hiring new talent is substantial.

COVID also brought a shift in perspective. People began to value life and sought to balance it with work. Businesses, in turn, realized that remote work was a feasible option and that employees didn’t always need to endure the daily grind of commuting to the office. The transactional nature of the employee-employer relationship became more evident. For HR professionals, maintaining trust and engagement in this new landscape became a significant challenge. Remote work made employee engagement even harder, leading to a gradual push toward a Return to Office (RTO). Employees who embraced the freedom of working from home may find this transition challenging, but many will need to adapt to the new realities. In response, employers are now striving to provide greater work-life balance than they did before the pandemic.

From an employer’s perspective, the relationship with employees has always been somewhat transactional. However, it’s the employees who, for the first time, truly embraced the concept of work-life balance, realizing that their careers didn’t need to dominate their lives. The pandemic gave people a new outlook, particularly younger professionals who now tend to be more demanding than their seniors. The older generation often found themselves more emotionally and financially dependent on their employers, making them less likely to push back.

All about Financial Independence, Retire Early (FIRE)

With this backdrop, let’s delve into the latest buzzword to emerge post-COVID: FIRE, which stands for "Financial Independence, Retire Early." This concept embodies two main ideas: 1) Achieving Financial Independence and 2) Retiring early.

Let’s explore these ideas further.

Financial Independence:

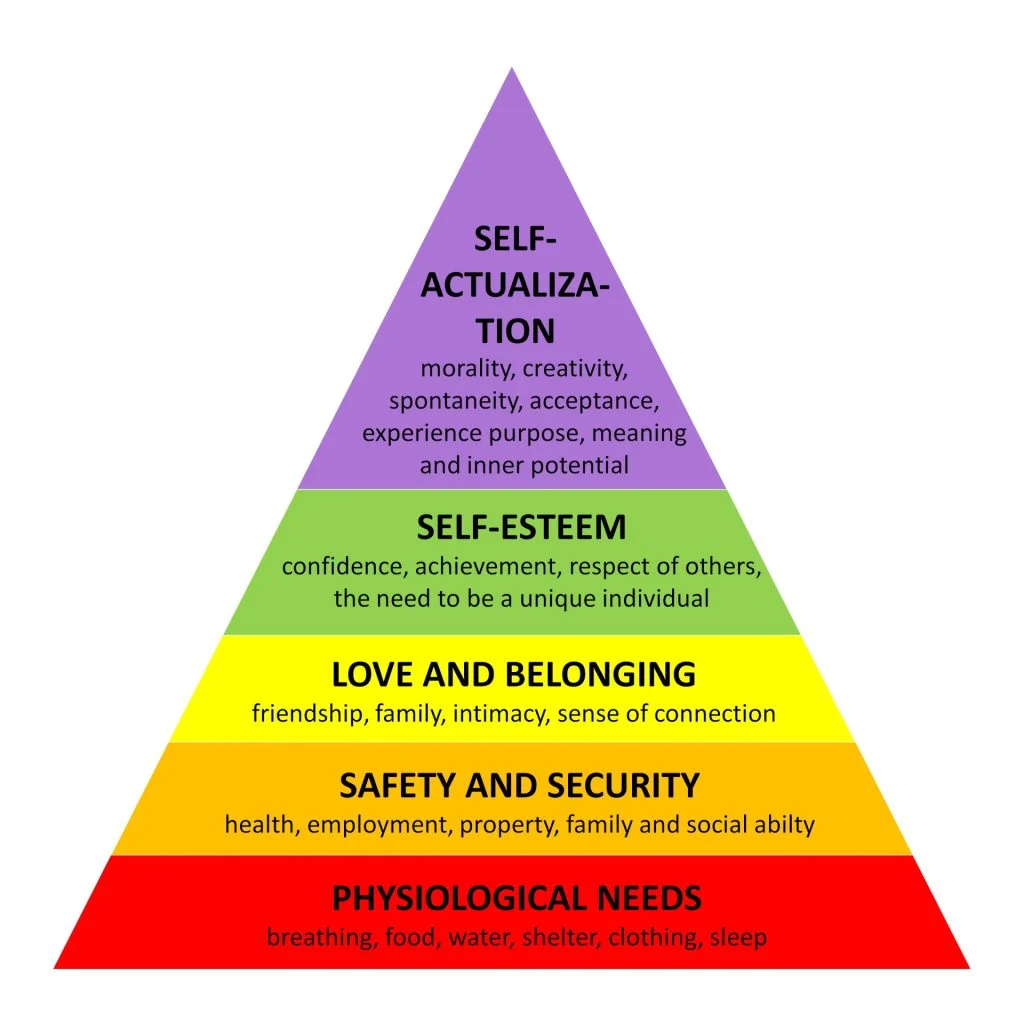

The term independence is inherently tied to its opposite—dependence. We can only understand independence in the context of financial dependence. Early in your career, the primary goal is to earn enough to meet your financial needs. Financial independence becomes meaningful when you realize the freedom it offers from depending on a steady paycheck to cover basic expenses. The definition of basic expenses gets subjective from here on. As you grow in life, you tend to expand the basic expense definition. Many new things get added to this as you grow. This can be easily explained using Maslow's hierarchy of needs.

Physiological needs are at the base of the pyramid of needs like food and shelter. Fulfilling the remaining needs beyond this level leads to greater happiness. While a house may be considered under Safety and Security, some may argue it falls under physiological needs. The focus here is on the fact that individuals strive to meet most of these needs during their lifetime, with only a few reaching 'Self Actualization'.

We should learn to make a distinction between needs and desires. Once physiological needs are satisfied, the emphasis shifts to psychological well-being.

It is important to recognize that you are a product of your surroundings, regardless of how you perceive yourself and what you think, defines you. Once you understand this, it will give you a better understanding of root of your desires. For example, if you have friends who love to travel, chances are you will desire to travel. If your friends/family enjoy food, chances are you will be a foodie. The desires are really an outcome of your surroundings and fundamentally there is nothing that 'Defines' you. This is difficult to understand because you have always believed that there are certain aspects that define you and you are unwilling to change what defines you. Pay close attention to your habits, likes, desires and you will realize this is all an outcome of your surroundings. If you change your surroundings, your desires will change too.

This may sound defeatist to many, but the reality is that in one life time nobody can fulfil all their desires because there are no limit to desires, which are shaped by people around you. Once you stop internalizing the external factors, you succeed in defining boundaries to your desires. Unless this is done, there will never be 'Financial Independence'.

Achieving financial independence occurs when our current assets can cover our future expenses to meet our needs. Many individuals lose sight of their initial motivation for entering the workforce, which is typically driven by financial dependence. People work to generate a steady income to meet their needs. As these needs are fulfilled, attention turns to fulfilling wants, which is optional. By prioritizing financial independence above everything else, one can focus on building assets to secure future financial stability. This approach helps avoid perpetual reliance on a job and ensures financial independence.

To summarize, Financial Independence is a state where an individual has built assets which can take care of their future cash flow to fulfil their needs. Once this state is achieved, you are not working for money any more. This is when you may get the ability to start your journey to the final stage in Maslow's hierarchy of needs, i.e. 'Self Actualization'.

Retire Early:

Lets look at the next stage of being Financially Independent. Once you have reached the stage when you can call yourself 'Financially Independent', you can choose to retire early. The retirement does not mean you stop working. You can continue to work, but you don't work for money any more. Imagine the independence in your thoughts, once you know you do not have to work for money alone.

Many confuse retire early with getting out of work early. Retirement doesn't mean not working, all it means is not having to work for money alone. Financial Independence early in your life will give back the time which you were renting so far to get the cash flow. You can focus on getting back your time to do things which are more meaningful to you.

I hear from people, what do I do if not work? This is a side effect of Industrial Revolution. It has converted Humans into efficient robots and made them believe that their only purpose in this world is to work for money. In fact, people do not appreciate the power of 'Not doing anything' enough. The thought of 'doing nothing' scares many because they never looked at it this way. As I said earlier, your desires are shaped by your surroundings, so is your need to do something. A majority has agreed to normalize 'doing' and their definition of 'doing' is to do something for Money.

Financial independence opens up a world of possibilities beyond the traditional notion of retirement. It allows individuals to redefine their relationship with work and money, emphasizing personal fulfillment and meaningful pursuits. By breaking free from the cycle of working solely for income, one can explore new passions, engage in creative endeavors, contribute to causes they are passionate about, or simply enjoy the freedom of time. The concept of early retirement, in this context, is not about idleness or escaping responsibility. Instead, it represents a shift towards a more purposeful and intentional way of living. It challenges the societal norms that equate productivity with worth and encourages individuals to prioritize their well-being and happiness above all else. Embracing the idea of 'not doing anything' as a valuable and enriching experience can lead to a deeper appreciation for the moments of stillness, reflection, and self-discovery that are often overlooked in a society driven by constant activity and productivity. Ultimately, achieving financial independence early in life is not just about reaching a financial milestone; it is about reclaiming your time and autonomy to live a life that aligns with your values and aspirations. It offers the opportunity to break free from the constraints of a money-driven existence and to pursue a more fulfilling and balanced lifestyle that prioritizes personal growth, relationships, and overall well-being.

Conclusion

After joining the workforce due to financial dependence, one must aspire to reach Financial Independence by creating assets which can take care of future cash flows. Once Financial Independence is attained (not an easy job), try to identify something that gives you more meaning and helps you utilize your time more efficiently to fulfil your dreams. It could be travel, reading, learning, anything that you would have wanted to do with your time, go ahead and do that. Work very hard to achieve Financial Independence early in life so that you can enjoy it in your prime instead of letting the external factors decide when you can get back your time. What is stopping you from taking back the control of your life?